If you have an Anthem health insurance plan, it likely includes coverage for addiction treatment services like detox, rehab, and behavioral therapy. These insurance benefits may help reduce your out-of-pocket costs for treatment for you or a loved one. In addition, your Anthem policy may provide coverage for things like prescription drugs during detox or aftercare services.

Sharp Health Plan continues to be recognized in California and nationally for their high-quality care and service. They are the highest member-rated health plan in California, and they also hold the highest member ratings for health care, personal doctor and specialist among reporting California health plans. As part of Sharp HealthCare's integrated delivery system, Sharp Health Plan directly connects members to an expansive network of nationally recognized doctors, elite-rated medical groups and hospitals. Who we areAnthem, Inc. is one of the largest health benefits companies in the United States. With local service and the value of the Blue Cross brand, we have been committed to ensuring our members have access to affordable health benefits for over 80 years.

Anthem BCBS insurance plans offer substance abuse and mental health coverage benefits. The level of coverage is dependent on your specific insurance plan.8 Anthem blue cross alcohol treatment and drug rehab coverage varies by state, policy, member, and provider. Many services are approved if they are medically necessary; therefore, alcohol, benzodiazepines, and opioid detox are often covered. Your overall health is important to us, and the university offers a variety of benefits to help support your physical and mental health. University of Louisville offers four health plans through Anthem Blue Cross Blue Shield.

We are happy to oversee the verification process for you so you can make the decision that is right for you financially and individually. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care.

If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. Your Anthem insurance coverage for drug rehab treatment varies depending on your plan level and the type of service you receive. Plans typically cover outpatient services, including office visits for substance use issues. A coinsurance cost would apply if you use an in-network provider. In most cases, you would not be covered if you select an out-of-network provider. A copay and coinsurance cost would apply for each admission.

Like outpatient services, if it's out-of-network, it is not covered. In 2004, WellPoint Health Networks Inc and Anthem, Inc. merged and became the nation's leading health benefits company. In December 2014 WellPoint Inc. changed its corporate name to Anthem, Inc. Anthem has about 40 million members and is ranked 33rd on the Fortune 500. Yes, a benefit year deductible applies for most medical services accessed outside the student health center . Visit theMy Coverage pageto check your plan's annual deductible.

This deductible does not apply to services with fees at an SHC, to emergency or urgent care clinic visits for students, or to pharmacy claims. For some UC SHIP campuses, the benefit year deductible does not apply to UC Family services. When you compare health insurance plans online, you can find information about premiums, benefit options, and local providers. This information will help you make a good decision about choosing BCBS vs Anthem for yourself, your family, or your small business. UC SHIP provides 100% coverage of allowed charges for emergency room services after a copayment, and 100% coverage of urgent care center allowed charges after a specified copayment. If Anthem determines that the reason for the visit was not an emergency, the coverage of the charges will be reduced.

The annual deductible does not apply to emergency room or urgent care center visits. If you are admitted to the hospital, UC SHIP will cover a percentage of inpatient charges, and the emergency room copayment will be waived. Visit theMy Coverage page to view the benefit levels, copayments and coinsurance for your campus. All follow-up care must be authorized in advance by the SHC.

Because of its large network of providers, giving you many choices for where you get medical services. Anthem has a variety of health insurance plans available including options for individuals, families, Medicare, Medicaid and group insurance. Cloyd has her health insurance coverage through her husband's job.

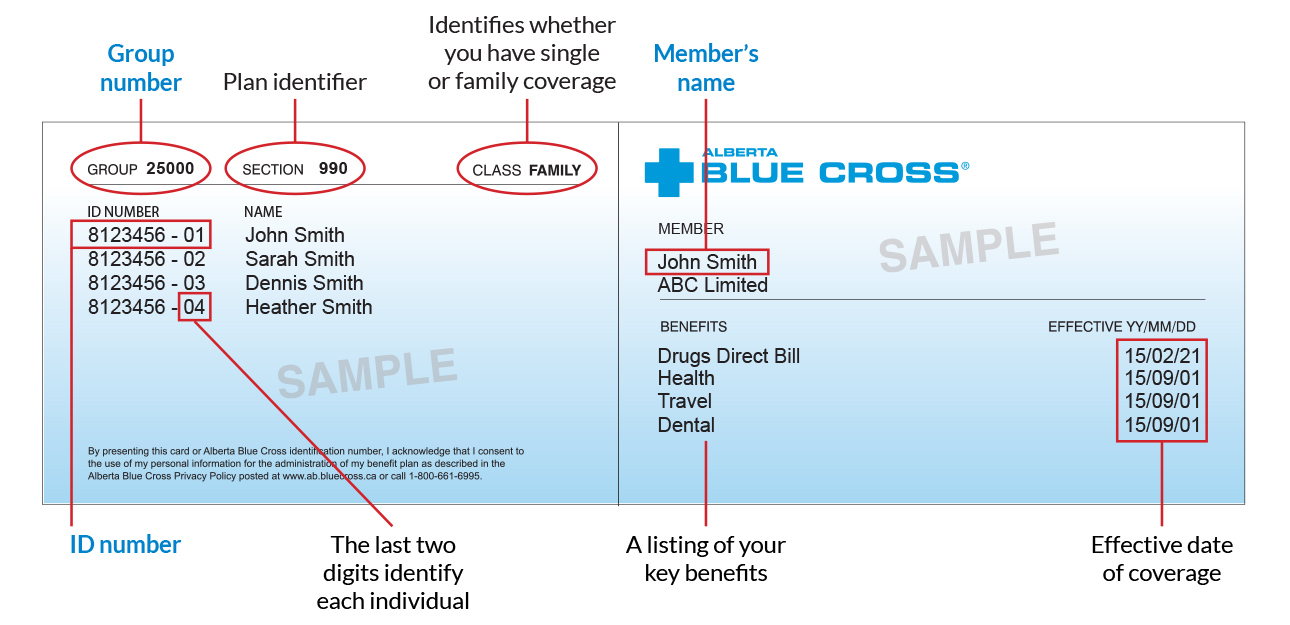

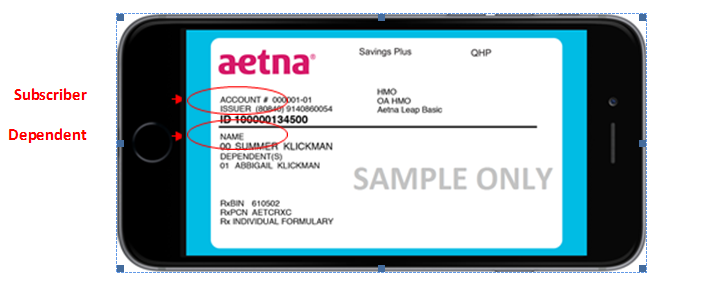

His company uses Anthem, one of the country's largest health insurance plans. In recent years, Anthem has begun denying coverage for emergency room visits that it deems "inappropriate" because they aren't, in the insurance plan's view, true emergencies. American Addiction Centers is in-network with many insurance companies, including Anthem at some of our facilities. Depending on the type of coverage you have and which state you live in, your addiction treatment could be covered. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company .

Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. To check if your Anthem Blue Cross and Blue Shield health insurance plan covers therapy services, head over to your Summary and Benefits document.

You'll likely find this document through your online Anthem Blue Cross and Blue Shield account. Within this document, you'll find the different rates of coverage — including copayment or coinsurance amounts — for each type of service available. Look for "outpatient mental health services" to see your coverage for therapy.

Yes, Anthem Blue Cross and Blue Shield does cover therapy services. However, the amount of the therapy cost they cover depends on your unique health insurance plan. Because Anthem Blue Cross and Blue Shield is such a large health insurance company, they offer many different types of plans across their various geographies.

This means that coverage for outpatient mental health services also varies widely. Anthem is a well-established provider of healthcare coverage that offers benefits not only in specific states, but access to a nationwide network of BCBS providers. They offer various plans and levels of coverage through employers, Medicaid, Medicare, and for current or retired federal employees. Checking your benefits can be done easily by contacting the company by telephone or through the member login website. While Anthem does offer coverage for addiction treatment, it's best to confirm what your benefits will cover so that you can focus on your recovery. If you need a service not offered at the SHC, your clinician will refer you to an off-campus health care provider.

The SHC will provide you with a referral to see the off-campus provider. This is not a guarantee of payment, and your deductible, copay and coinsurance will apply. Your SHC clinician may suggest a specific provider, or you can choose a provider. However, we strongly recommend that UC SHIP members see providers who belong to the Anthem Blue Cross Prudent Buyer PPO network, including UC Family providers. Doing so ensures UC SHIP members will pay the lowest out-of-pocket costs.

Whether Anthem Blue Cross and Blue Shield covers couples counseling depends on the plan. Generally, health insurance plans do not cover couples therapy. This is partially because there cannot be a diagnosis to base the reimbursement upon. However, some Anthem Blue Cross and Blue Shield plans may provide coverage at the same or differing rates as individual therapy. To see if yours does, visit your Summary and Benefits document.

Even Medicare health plans with a national presence can vary locally in their cost, quality, and customer satisfaction. We included the National Association of Insurance Commissioners' complaint index and AM Best's financial stability ratings. We also considered information from the companies on their programs and strategies. Anthem's PPO plans, called Anthem MediBlue PPO, offer more flexibility in accessing providers than the HMO plans.

Though PPO members still choose a PCP, you don't need to go through your PCP to get a referral to a different doctor or specialist. Members can see doctors outside the Anthem network on the PPO plan, though you may pay more. For 2021, Anthem offers 1,214 local PPO plans with prescription drug coverage and 233 without. Anthem is a leading health benefits company dedicated to improving lives and communities, and making healthcare simpler. Through its affiliated companies, Anthem serves more than 79 million people, including 41 million within its family of health plans.

We aim to be the most innovative, valuable and inclusive partner. For more information, please visit or follow @AnthemInc on Twitter. WHA offers affordable, quality health care to its neighbors in Marin, Napa, Sacramento, Solano, Sonoma, Yolo and parts of Colusa, El Dorado, Humboldt, and Placer counties. However, not all small, independent pharmacies have the correct computer system to validate your transaction, in which case you'll need to pay for the prescription using another form of payment. Each UC SHIP campus has its own out-of-pocket limits , depending on where you access care.

Visit the My Coverage page to review your campus's benefits. Medical and pharmacy copayments, as well as coinsurance and the deductible, apply toward the out-of-pocket maximum. You will pay a lower out-of-pocket maximum if you receive care from the SHC and network providers. You will pay a higher out-of-pocket maximum if you visit out-of-network providers. Medicare Advantage, in particular, has been a target for Anthem and health insurer rivals as more seniors flock to such coverage.

Most Anthem insurance policies cover drug and alcohol rehab but depending on your individual plan, Anthem may provide partial or full coverage. If you'd like to find out the extent of your Anthem insurance coverage for rehab, we can help. We can verify your health insurance benefits over the phone in just a few minutes. However, Anthem Blue Cross and Blue Shield is dedicated to whole-person health, which includes mental health care.

For this reason, they provide coverage across the majority of their health insurance plans. Our Signature plan offers access to a full network of contracted providers with more than 62,590 physicians and health care professionals, and 273 hospitals. The Advantage, Alliance and Harmony plans offer the same level of benefit coverage as our Signature plan but has a narrower network of contracted providers.

You can find listings for physicians and hospitals in our provider directories. UnitedHealthcare Signature1 - The Signature plan includes our full network of contracted providers. With this HMO plan, members simply choose a primary care physician from our full network of contracted providers to coordinate all their medical care.

They can then visit their PCP for routine checkups, and when they need to see a specialist, their PCP provides a referral. Members are charged only a copayment for each doctor's visit. With Sutter Health Plus, members gain access to an integrated network of high-quality healthcare providers, including many of Sutter Health's hospitals, doctors and healthcare services. If you use an in-network provider, you don't need to file a claim — your doctor will file one with Anthem. Anthem will then pay your doctor amounts it covers under the Health Account Plan and send you an Explanation of Benefits .

Health coverage through Anthem offers access to an extensive network of providers for all your medical, prescription drug and mental health care needs. You might see another list with 2 different percent amounts. UC SHIP offers a range of benefits, including coverage for specialty office visits, prescriptions, diagnostic services, surgery, hospitalization and out-of-area care while traveling, to name a few. The UC SHIP package also includes strong dental and vision benefits and covers most SHC fees. The rate you pay for insurance will vary based on your personal details, where you live and the level of coverage you select.

In 2022, individual health insurance plans are likely to be priced slightly higher, and the rate of increase varies by state. Anthem's Medicare Advantage HMO is called Anthem MediBlue HMO. Members need to choose a primary care provider who provides most of their care and serves as a gatekeeper to specialists. These plans typically have lower monthly premiums than PPOs. In 2021, Anthem offers 1,829 HMO plans with prescription drug coverage and 84 plans without.

Anthem offers a wide range of plan options and covers a fairly wide geography with extra benefits and competitive customer service options. These plans earn average quality ratings from CMS, with a few standouts. Anthem plans aren't rated by NCQA, one of the main health insurance accrediting bodies, so it is hard to compare them to other national competitors.

Anthem insurance will typically pay for individual therapy costs for substance use disorders and other mental health conditions. With a mix of benefits that deliver patient-centered care, health and wellness programs and award-winning customer service, UnitedHealthcare is a smart choice for your family's health care coverage needs. UnitedHealthcare of California is committed to providing quality coverage and affordable benefits to help keep you and your family healthy. Our plans offer more than just doctor visits; preventive care services are also provided for every member of the family. The MetLife DHMO plans provide access to a large network of dental providers throughout California. Preventive dental care is an important part of overall health and MetLife is committed to ensuring that its members receive a high level of dental care.

As part of this commitment, all Quality Management Activities are designed to meet or exceed NCQA standards. These standards are applied to plan design, through the credentialing of network providers, member services standards and on-going peer review and facility audits. There are also 12-step programs, such as Alcoholics Anonymous and Narcotics Anonymous , which anyone can attend.

You pay 20% of the cost for all specialist office visits after you meet the annual deductible. Your specialist may charge you up to the full amount of your deductible at the time of service, and you may need to file a claim to get reimbursed. You can visit any provider or specialist of your choice without preauthorization from your primary care doctor. If you use an out-of-network provider, you may need to pay your doctor up front and then file a claim with Anthem.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.