Small banks generally possess just one routing number, while large multinational banks can have several different ones, usually based on the state in which you hold the account. Routing numbers are most commonly required when reordering checks, for payment of consumer bills, to establish a direct deposit , or for tax payments. The routing numbers used for domestic and international wire transfers are not the same as those listed on your checks. However, they can easily be obtained online or by contacting your bank.

In the US, banks and other financial institutions use routing numbers to identify themselves in a domestic wire transfer, international wire transfer, or another purpose. Bank of America's routing number comprises 9 digits and sometimes called routing transit numbers, ABA routing numbers, or RTNs. From setting up direct deposit to making ACH payments and wire transfers, you'll need a routing number to complete many kinds of banking transactions.

As a large national bank, Bank of America has a different routing number for each state, as well as additional numbers for domestic and international wire transfers. Depending on the financial institution and where the sending bank is located, it can take between one and six business days. Typically for domestic transfers, it will take one day, and for international wire transfers, it can take between three and six. After seven business days and if you haven't seen any new transactions in your account, contact your bank to see what the problem might be.

Routing numbers are codes of between 8 and 11 digits used by Bank of America and other banks to help financial institutions identify the location of your account. Called ACH, wire transfer and SWIFT numbers, they're used to process checks, set up autopay, make online payments and transfer money in the US and around the world. Learn how to find the exact routing number you need for your Bank of America account.

The SWIFT Code is a standard format for Business Identifier Codes that is used to uniquely identify banks and financial institutions globally. These codes are used when transferring money between banks, especially for international wire transfers or SEPA payments. When 8-digits code is given, it refers to the primary office.

When transferring money in Europe, you will often be asked for a SWIFT/Bic number. The Fedwire Wire Transfer service is the fastest way to transfer funds between business accounts and bank accounts int he US. It is used for domestic or international transactions where the account balance is directly debited electronically and the funds are transferred to an account in real time.

Banks tend to charge between $10 and $30 for domestic wire transfers, and between $30 and $50 for international wire transfers. In 2018, wire transfer fees can be avoided by using services like transferwise. You will require a few details to send or receive money via wire transfer either in the US or even international transfers, where money moves typical. Bank routing numbers can help identify banks when processing domestic ACH payments or wiring transfers only in the United States.

You do not need one to institute payments to your friend in France, for instance. ACH Routing Numbers is an acronym for for Automated Clearing House routing numbers. This number is used for America electronic financial transactions. The first four digits identify the Federal Reserve district in which the bank is located and the following four numbers identify the bank.

The last number is referred to as a check digit number, which is a confirmation number. ACH Routing Numbers are used for direct deposit of payroll, federal and state tax payments, dividends, annuities, monthly payments and collections, etc. International wire transfer is one of the fastest way to receive money from foreign countries.

Banks use SWIFT network for exchanging messages required for performing international wire transfer. Usually, the receiving bank and the sending bank need to have a direct arrangement in place to start the swift transfer – this is sometimes referred to as correspondent banking. You can receive funds to your Bank of America NA account from any bank within USA using domestic wire transfer. You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution.

Account numbers are a lot like a customer ID, or fingerprint, that is specific to each account holder. Similarly, routing numbers identify each banking institution with a unique numerical ID. Routing and account numbers are assigned to indicate exactly where funds in a transaction are coming from and going to. Any time you make an electronic funds transfer, for instance, both the routing and account numbers must be provided to the relevant financial institutions. For example, you will be asked for both your routing and account number if you set up employee direct deposit or automatic bill pay.

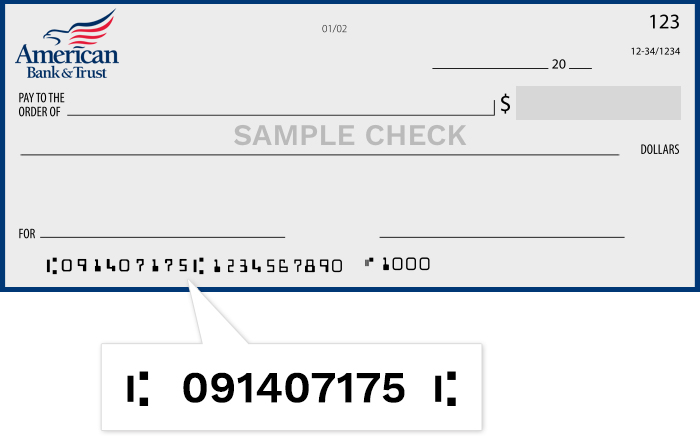

Both numbers will also be required when you order new checks and when you send or receive a wire transfer. Routing numbers are also known as "Check Routing Numbers", "ABA Numbers", or "Routing Transit Numbers" . The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association . The number determines the financial institution upon which a payment is drawn.

Each routing number is unique to a particular bank, large banks may have more than one routing number for different states. Routing numbers may differ depending on where your account was opened and the type of transaction made. Also note that the routing number on your checks will not work for wire transfers. When processing a wire transfer, you will need a separate routing number.

You will also need a BIC code if it is an international wire transfer. The American Banking Association has assigned a 9 Digit Unique identification numbers to financial institutions. The Routing Number can be used for different purposes such as wire transfers, direct deposit , ordering paper checks etc. Routing numbers help banks identify your exact account to make digital payments, transfer money and even process paper checks between branches, states and countries. Learn more about how Bank of America and other financial institutions use these codes to manage your money in our guide to routing numbers. Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution.

The Federal Reserve Banks uses ABA RTNs in processing Fedwire funds transfers. The ACH Network also uses ABA RTNs in processing direct deposits, bill payments, and other automated money transfers. In the United States, an ABA routing transit number is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn.

A routing number is a nine digit code, used in the United States to identify the financial institution. Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH direct deposits, bill payments, and other automated transfers. The ABA Routing Number is a 9-digit identification number assigned to The American Bankers Association's financial institutions.

The number identifies the financial institution in which the payment is drawn. Routing numbers are sometimes called Check Routing Numbers, ABA Numbers, or Routing Transit Numbers . Routing Numbers differ depending on the state in which your account was opened and the type of transaction being made. This is one of the important numbers you will need for direct deposit, send money via wire transfer, and ordering checks. These numbers work together with your routing number to uniquely identify your account. A routing number is used if you are attempting to set up direct deposit, send wire transfers, order new checks, or send money to someone.

Wire transfers are a quicker way to send money than an ACH transfer. Anyone can wire funds to your Bank of America account for a small fee. You can even set up a domestic or international wire from your local Bank of America branch. A Bank of America routing number is used to complete financial transactions such as direct deposit payments, bill payment, and tax payments. Your routing number serves as the location identifier for the financial institution you opened your account with.

The routing number for domestic and international wire transfers for Bank of America are the same across all states. The checking and saving account routing number and the ACH routing number for Bank of America varies state by state, you can find these in the table above. Your Bank of America routing number is important for a number of financial vehicles. Routing numbers also identify the financial institution when you send or receive money. These codes are just like your checking accounting routing numbers. The work of the SWIFT codes is to identify the bank or financial institution in which the finances will be processed.

They are also known as BIC codes and relevant for international payments. Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. The Federal Reserve uses the ABA RTN system for processing its customers' payments. Check processing is now centralized at the Federal Reserve Bank of Atlanta.

In addition, many international financial institutions use an IBAN code. Do you have a hard time finding therouting numbers listfor Bank of America? Bank routing numbers are used for online payments, direct deposits, or wire transfer money. And yes, we have a good list of Bank of America Routing Numbers right here. So for example, when you have direct deposit, your paycheck is put into your bank account. The routing number in this case tells the money which financial institution to go to.

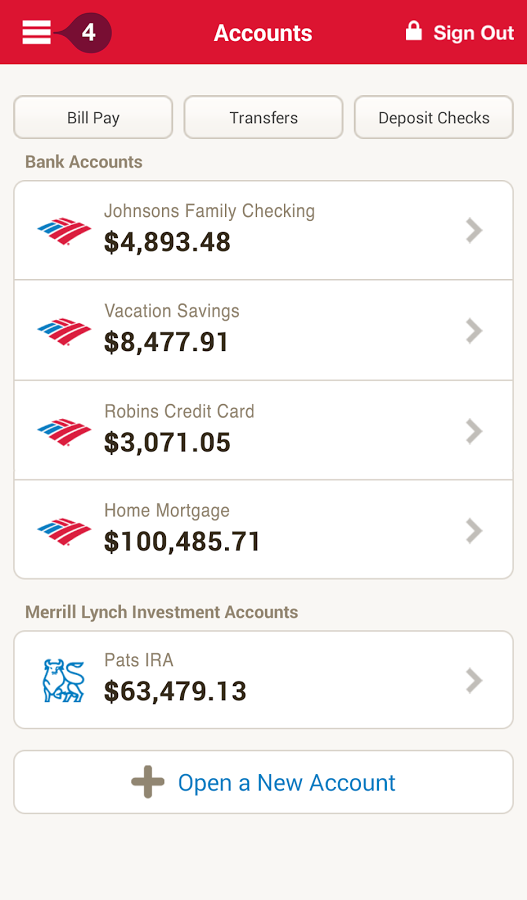

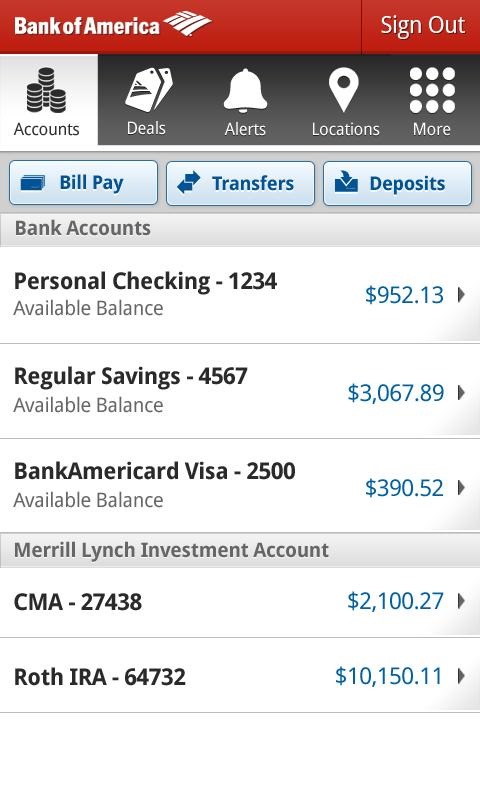

Your Bank of America Routing Number plays an important role in directing where your money should go. It identifies a particular financial institution and can streamline transactions like direct deposits or making payments. You can easily find your routing number on this page, on your checks or by logging into your online account.

A routing transit number is a nine-digit number that identifies a bank or financial institution when clearing money for electronic transfers or processing checks in the US. The American Bankers Association established these numbers. The terms «routing,» «transit» and «ABA» number are all used today and have the same meaning.

Wire transfer is the fastest mode of receiving money in your Bank of Americaaccount. You can receive money from within USA or from a foreign country . The transaction is initiated by the sender through a financial institution, however, you need to provide your banking details to the sender for successful transfer of money. Caution commercial banks will charge large fees on the money you send because of their overhead. Transferwise is a great option for international wire transfers due the low cost and ease of use.

The sender will need the following information to successfully send money to your Bank of America account. Ensure the SWIFT/BIC number is given correctly to ensure there is no issue in receiving your transfer. Some banks have different SWIFT/BIC codes for foreign currency and US dollar transfers due to the conversion rate of different currencies.

Also note that the cost to send a wire transfer can be substantial. This number identifies the financial institution upon which a payment is drawn. Routing numbers are sometimes referred to as "check routing numbers", "ABA numbers", or "routing transit numbers" . A checking account is a deposit account held at a financial institution that allows deposits and withdrawals.

Checking accounts are very liquid and can be accessed using checks, automated teller machines, and electronic debits, among other methods. We have also included a guide to Bank of America international and domestic wire transfers, plus the BofA opening hours and wire transfer business hours. The routing number is a very significant digit for international transactions.

These numbers help in the identification of banks whenever you are processing a domestic ACH payment, and it's also useful in wire transfers. But the thing is the routing number is used basically in the USA. Also, you can connect with 24 hours available customer services of bank of America to confirm your bank of America direct deposit routing number.

It means if you are a customer of any financial institution or banking institution in the USA, your banking branch has a unique routing transit number. Hence, Routing Number Bank of America is the Routing transit number on check bank of America. Further, the Federal Reserve Routing Symbol and ABA Institution Identifier may have fewer than 4 digits in the fraction form. For domestic and international wire transfers to Bank of America in US, the routing number is . If you bank with Bank of America, then knowing or keeping your routing number on you is important when it comes to managing your finance.

Having this on hand will help you set up direct deposit, automatic payment, or wire transfer. An ABA routing number is used for paper or check transfers. An ACH routing number is for electronic wire transfers or through online banking. Still, the ABA routing numbers and ACH routing numbers may be the same in some institutions, while they can also be different. A routing number is a 9-digit code that banks use to identify themselves.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.