When you're buying potting soil for your plants, it's easy to get overwhelmed by the types of potting mixes available and the many ingredients those mixes contain. For the best potting soil for succulents, start with a basic cactus and succulent soil mix, or even an African violet mix, available at most garden centers. Then add some extra ingredients to find the one that will make watering easier, improve the drainage, and hold up a long time without compacting.

Mixes you buy contain sphagnum peat moss , coarse sand, and/or horticultural vermiculite and perlite. If you wish to make your own potting mix, choose from these ingredients. If you already have a houseplant mix that you want to include, add 1/3 coarse sand to bring it to the porosity you need. As you can see, there is no "soil" used in the mixes.

In fact, many houseplant potting mixes contain no soil at all. Potting soil, also known as potting mix, is comprised of various ingredients that provide a healthy environment for potted plants to grow. These mixes are designed to keep the soil from becoming too compacted, which can suffocate roots and impede the flow of water and nutrients.

A high-quality potting mix will be lighter weight and fluffy, with the ability to hold moisture. There are many different types of all-purpose blends, as well as more specialized mixes. Peat moss is a common ingredient in potting mixes because it is able to retain water without compacting or becoming waterlogged. This allows the roots of potted plants to continue soaking up moisture without sacrificing the aeration that the plant needs to thrive. Mixing peat moss with soil can counteract some of the soil's tendencies to compact in potted plants, or peat moss can be used without any soil.

The other main ingredient is an inorganic substance that allows water to soak into and then drain out of soil quickly, keeping the mix crumbly and airy. A more challenging choice is to make your own potting mix. A basic recipe is to combine one part compost, one part peat moss and one part perlite or vermiculite. If you don't have compost, one part peat moss to one part perlite also works, but you should never allow compost to comprise more than a third of your potting mix. Other ingredients to add to your recipe include limestone, which helps balance the pH of the mix , and fertilizers, such as fish emulsion.

The University of Florida IFAS Extension offers an array of recipes for potting mix intended for different types of plants, from succulents to bromeliads to seedlings. "Use new potting soil as you re-pot the plant and make sure it's watered in well, but again doesn't stay wet for longer than minutes," says McEnaney. With time, African violets may become overgrown and begin to crowd their pots. Use leaf cuttings from these plants to propagate, or start, new African violet plants.

Once plants have 4-5 leaves, they can be repotted into African violet pots. Fiddle leaf fig trees are susceptible to root rot, so you'll want to make sure your container has perfect drainage and that your plant will never sit in water. This means a container with a drainage hole, along with cactus mix or other materials like Smart Gravel to keep your root ball dry. The University of New Hampshire Cooperative Extension lists other common ingredients in potting mixes. Compost can add nutrients to the soil but should compose less than a third of the total mix. Fertilizer and water-storing crystals may also be used to help plants get the water and nutrients they need.

It's important to first understand what ingredients go into a standard potting mix and how they can provide benefits to potted plants. Remember that potting soil is exclusively designed to be used for potted plants. If you want to grow plants in your garden or in raised beds, you'll want to stick with regular garden soil. A main ingredient of any potting mix for succulents will be organic matter.

Peat moss, the main ingredient in most potting soils, is hard to wet and then dries out quickly. By adding a little finely ground bark, water will penetrate more quickly. For homemade mixes, a great substitute for peat moss is coir, which is fibrous shredded coconut husks and is very slow to decompose. Unlike peat, coir is easy to wet when it dries out.

Compost can be used as well, though it decomposes very quickly. What you may use in the garden for hardy landscape succulents will likely vary a lot from what you use in containers. African violet mixes also are slightly more acid than regular house-plant potting soil. Soilless mixes usually contain sphagnum peat moss and sand, or horticultural vermiculite or perlite and a small amount of African violet fertilizer.

Money Trees are susceptible to root rot, so their most pressing need is to be able to drain efficiently. The best soil is peat-based, potting mixes like cactus blends. The pot you select needs a drainage hole and should be one size larger than the pot it was in. You'll need to get a container that is 3-4 inches larger in diameter than your plant's current container. Grab a tape measure to make sure your new container is both wider and taller than your existing container.

Don't go too big, as too large of pots can promote root rot. At most, the new pot should be 6 inches larger in diameter than the current pot. Most large fiddle leaf fig trees at Home Depot are in 12- or 14-inch containers, so a 16- or 18-inch pot will work. Your new pot will need holes at the bottom for drainage or it's plant homicide.

I find the easiest container to use is a large ceramic pot like the one below. These containers have drainage holes on the side, designed to keep the roots dry as a bone. That's because the growers water their plants daily to soak the roots and the growing pots are designed to drain immediately.

This reduces the risk of root rot, but it's dangerous for your plant once you get it home. I don't recommend using beach sand in your succulent potting soil mix. Also, beach sand could contain things like salt or pathogens that can harm your plants. It's best to buy it at the store to avoid any problems. After years of trial and error, I finally came up with the perfect succulent potting mix recipe.

This is the best soil for succulents, and it's super easy to make too! In this post, I will share my recipe and show you exactly how to make your own succulent soil. The two main reasons to use a potting mix rather than garden soil is to ensure that your potted plants are receiving plenty of air and plenty of moisture. Peat moss and perlite are two crucial ingredients for accomplishing that goal. Give your potted plants a natural boost of nutrients with our selection of organic potting soil. Potting soil contains iron, potassium, and other nutrients both indoor and outdoor potted plants need to thrive.

Our natural and organic potting soil is made from naturally-derived ingredients, perfect for eco-friendly gardeners. African violets prefer to stay evenly moist - ideally the soil feels like a well wrung-out sponge. They do not like to dry out completely in between waterings, but they do not like to be sopping wet all the time.

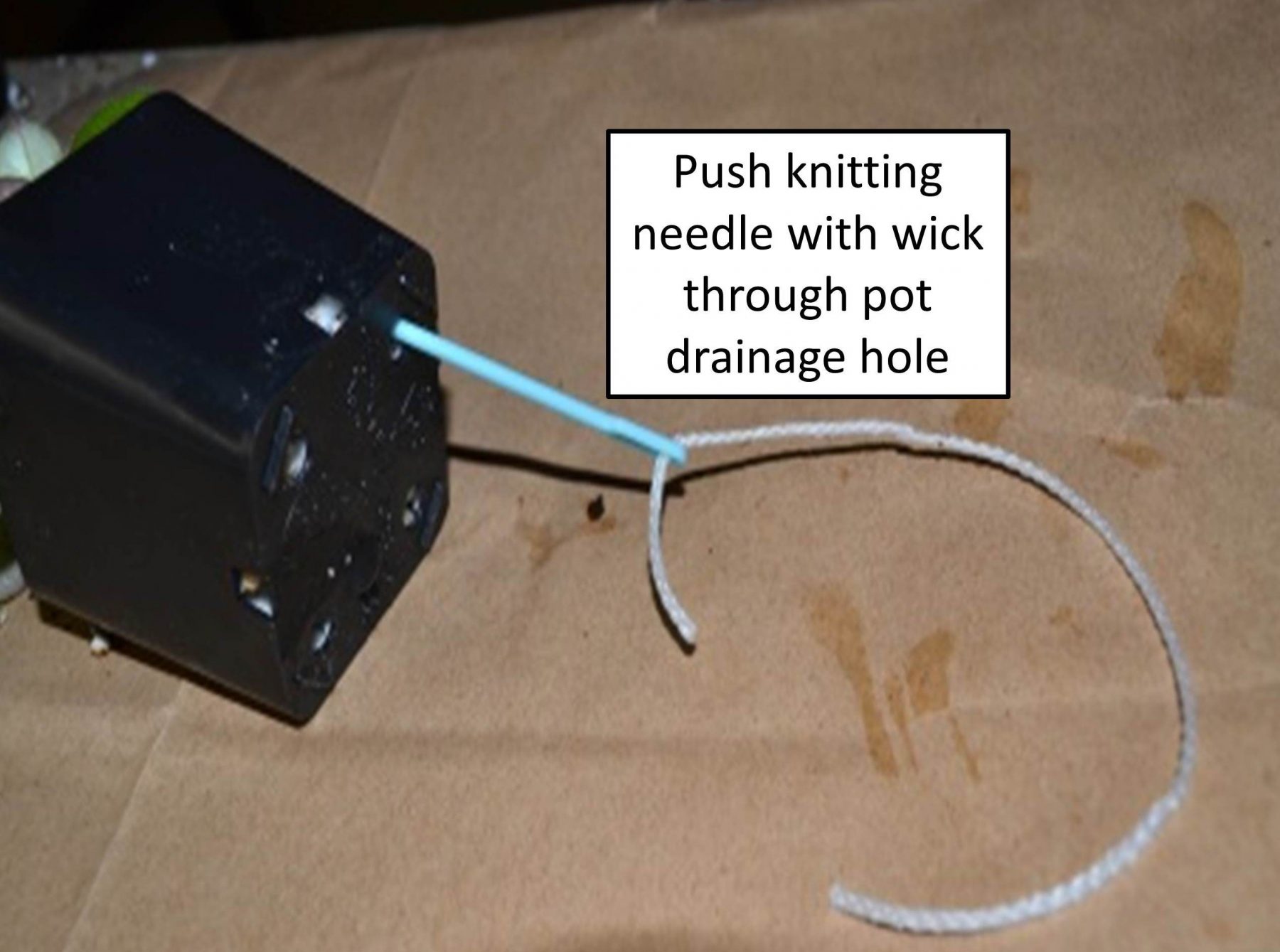

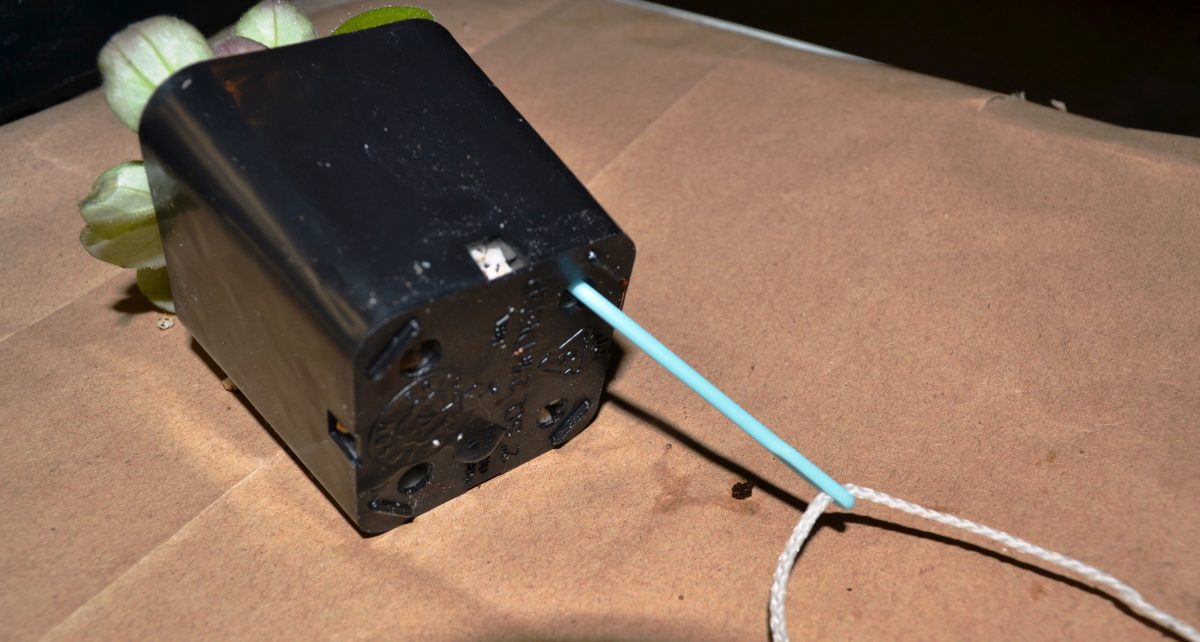

Too much water can lead to root rot, while roots start to die in soil that is too dry much of the time. Either way, plants with reduced roots systems often sacrifice flowering in order to survive. For best results, plant African violets in African violet pots, which are small (4- to 5-inch) ceramic or plastic self-watering containers.

Growing plants in these pots will provide the proper amount of continuous moisture to the plants. Plant the violet in soil in in the top pot and fill the second or lower pot half full with room temperature water. Set the violet in the top pot into the bottom pot with water. The water will seep through the bottom of the top pot to keep the violet moist. The violets need to be fertilized occasionally with small amounts of African Violet food sprinkled and mixed into the water in the lower pot.

I later pinch the lower larger leaves off of a plant to start more plants to give to friends so that the violet can spread out and grow well. Tropical plants and flowers thrive with a higher acidic level, which is why Miracle-Gro African Violet and Tropical Plant Potting Mix is a great choice for these plants. The special formulation of the potting mix provides an acidic pH to help build strong root systems. Enriched with Miracle-Gro plant food, the potting mix will feed the soil for up to three months. Then, she suggests making an indentation in the soil for the plant and set it in the pot.

Add more soil to cover the root system, without burying it any deeper than it was in the old pot, and pat down gently. When resettling a plant deeper in a pot, gently scrape the bare stem to remove the heavy bark that forms when leaves are shed. You can repot your violets once a year, separating any new crown growth to make new plants, although African Violets that are slightly root bound will tend to bloom more. When repotting your African Violets, put them into pots that are more wide and shallow rather than deep, their roots grow out not down.

Too much moist soil under their roots can lead to root rot. Remember that in their native home they grow on rocks. Finally, if you have recently repotted your African violet into a larger pot, the pot may be too big.

African violets prefer to be root-bound to bloom well. It is good practice to periodically repot houseplants because the soil should be refreshed periodically. You can often repot the plant into the same pot after cleaning it well, using fresh potting mix. As a rule of thumb, pots should be no larger than one-third the size of the diameter of the plant. Because African violet roots break easily, try to keep the damage to a minimum.

Trim away rotting portions of the roots, and repot the plant in a clean pot that has bottom drainage holes. A potting mix formulated for African violets drains freely and contains chunks of bark, which allows air around plant roots. The keyword to keep in mind when choosing soil and pots for your Money Tree is drainage. The soil should mostly consist of well-draining materials with a dash of organic material. Your pot should have multiple drainage holes to keep the roots dry.

And remember, when repotting, find a container that is a similar size to your current pot or invest in a slightly larger sized pot. The vast majority of potting soils are created from a peat moss base. Peat moss is easy to find and also retains a bit of moisture for the roots. Once there are some roots, transplant each leaf into a pot with soil. The leaves should be planted at a 45-degree angle.

Depending on the size of the pot, you can plant them either one or two per pot. Some people prefer to skip steps 3 and 4 and plant the leaf cuttings directly into the soil. This is an option as well, but it may be a bit boring for some people since you won't get to watch the new roots appear. Also, you'll need to be careful to not keep the soil too moist or it may cause the leaf to rot. Fiddle leaf figs can dry out and suffer permanent damage within just a few days in these pots, so don't wait to repot your plant. Share your succulent potting soil mix recipe in the comments section below.

Perlite retains very little moisture, prevents soil compaction, and helps add better drainage for succulents. In other words, it helps the soil drain faster which is exactly what we want for succulent potting soil. You can find these ingredients at any store with a gardening section. The right potting mix for African violets allows air to reach the roots. Typical houseplant soil is too heavy and restricts airflow because the decomposed peat it contains encourages too much water retention.

This type of soil can cause the death of your plant. Used potting soil can be rejuvenated, though there is an increased risk of disease if not done properly. If the mix smells bad or is moldy, spread it out in the sun and allow to dry in order to kill pathogens. Add fresh peat moss or coconut coir to make the soil lighter. Nutrient-rich additives can include compost, earthworm castings, bone meal, and kelp meal.

Used potting soil can also be recycled into flower beds, vegetable plots or the compost pile. Don't reuse soil from a container where a diseased plant has grown. I water from the top and regularly get water on the leaves.

I have some in the south-facing window and some in the north-facing window. I repot them with new soil every year or two; sometimes it's regular potting soil and sometimes it's African Violet potting soil; whichever I grab. I often forget to water them and then saturate them.

I've had mine 15 years and they're all doing fine and bloom regularly. Knowing when and how to water your African Violets is of prime importance. The roots of the African Violet need aeration, so keeping them moderately moist but never soggy is the key. Watering from the bottom so they can soak the water up, over an hour or so, will help to keep water out of the crown of the plant. African Violets like warmer water, around 70 degrees.